Corporate Regulatory Fines in the First Year of the Trump Administration

We Assess the Monetary Fines and Settlements of Large US Public Corporations During the First Year of the Trump Administration

-

We examine the current constituents of the Russell 1000, an index of large and mid size US public corporations. We do not include foreign, private, or smaller US corporations.

-

The fines data come from the Goods Jobs First Violation Tracker, a comprehensive database of over 2,800 parent companies capturing fines from over 50 federal regulatory agencies and all divisions of the Justice Department since the year 2000.

-

The Violation Tracker assigns subsidiary fines to the current parent company, even if the subsidiary was part of a different corporation when the penalty was imposed. This maintains the integrity of the database, as fines do not disappear simply because a subsidiary or full company was acquired.

-

There are over 300,000 fine entries in the database totaling 412 billion dollars since the year 2000. Of these, 213 billion were assessed on current Russell 1000 constituents. 69% of current Russell 1000 companies have at least one fine. We report fines in nominal US dollar terms, not accounting for inflation.

-

Presidential years as used in this study are the full years beginning on January 20 (Inauguration Day).

Fines and Settlements Since Start of Bush Administration

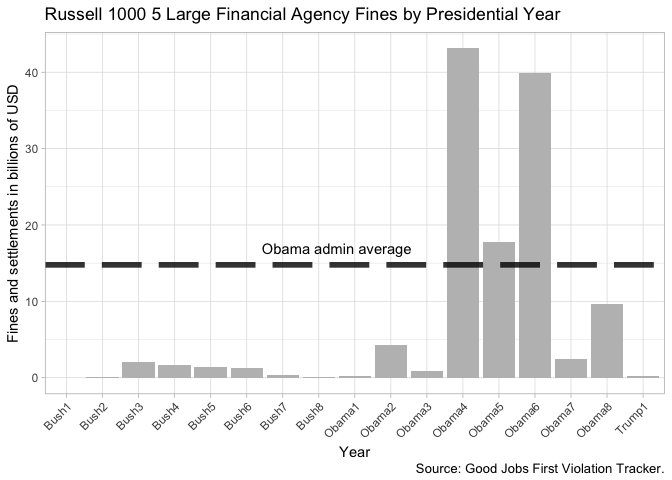

Over the combined 16 years of the Bush and Obama administrations total US government fines averaged 12.9 billion USD / year. Following the Global Financial Crisis, total fines averaged 31.3 bn in the last 5 years of the Obama administration, compared with 4.6 bn in the 8 Bush years and first 3 Obama years. Total fines in the first year of the Trump administration were 3 bn, an 77% decline compared with the Bush-Obama average, and 35% below the Bush and first 3 Obama years.

We note that fines may be lumpy and volatile year-to-year, and jumped as regulatory enforcement increased as a result of the GFC. As the GFC recedes, it is to be expected that the related very large fines and settlements from financial regulatory agencies should decline significantly. The agencies accounting for the majority of the increase in fines in the last 5 Obama years are the FHFA (including Fannie Mae and Freddy Mac), the SEC, the OCC, the CFTC, as well as major multi-agency referrals to the DOJ. Combined, these five large entities were responsible for over 40 billion in fines in 2012.

Fines and Settlements Excluding 5 Financial Agencies

To evaluate monetary assessments in the first year of the Trump administration, controlling for the impact of the natural decline in financial fines, we’ll examine fines excluding those from the 5 financial agencies mentioned. This will provide insight into the degree of enforcement in non-financial agencies.

Non-financial agency fines in the first year of the Trump administration were 2.8 bn, a 46% decline (-2.3 bn) compared with the Bush-Obama average of 5.1 billion USD / year, and the lowest in 13 years.

What Agencies Drove the Decline in Non-Financial Fines in Trump’s First Year?

While the Violation Tracker includes over 50 agencies, we can trace the drop-off in enforcement activity to just 3 agencies: the EPA, the FDA, and the DOJ’s Criminal Division. These 3 agencies account for 95% of the decline in assessments versus the historic average.

EPA fines on Russell 1000 constituents declined to 0.3 bn in the first year of the Trump administration, an 79% decline compared with the previous 16 Presidential years average of 1.6 bn.

There were no FDA fines on Russell 1000 constituents in the first year of the Trump administration, a decline of 0.8 bn compared with the average of the previous 16 Presidential years. There were also no FDA fines in the final year of the Obama administration, though they were historically elevated in the first 5 years. It should be noted that most of the FDA’s regulatory actions do not involve monetary penalties, but rather, the closing of non-compliant facilities until problematic issues are rectified.

The Department of Justice Criminal Division’s Russell 1000 fines declined to 97.4 mn in the first year of the Trump administration, a 62% decline compared with the previous 16 Presidential years average of 259.8 mn.

Conclusions

We’ve shown there’s been a significant decline in the monetary fines assessed on America’s largest public corporations during the first year of the current administration. Total fines were 77% lower than the average of the previous 16 Presidential years. Excluding fines from the major financial regulators, expected to decline as GFC-related enforcement diminishes, fines were 46% lower than in the previous 16 years. The decline in fines can be majority accounted for by declining EPA, FDA, DOJ Criminal Division fines.

We see three plausible explanations for the decline. 1) Following a period of strict oversight corporations may be on their “best behavior”. Furthermore, they are focused on avoiding the limelight of public and presidential discussion on social media. 2) The administration has been notoriously slow to fill positions requiring Senate confirmation, on track to see the slowest pace in 40 years, according to the White House Transition Project. This could result in a slower pace of enforcement at regulatory agencies. 3) A decline in monetary enforcement may be an implicit or in some cases, explicit, goal of regulatory agency heads. The willingness of staff and agency heads to bring cases forth may have materially declined. These three possibilities are not mutually exclusive and are likely manifesting themselves to some degree.

It’s important to acknowledge that fines data are volatile, and one year may not be enough time to ascribe responsibility to any of three above options. Furthermore, the notion that the first year of a Presidency necessarily involves diminished regulation is not borne out by the first year of the Obama administration when fines rose over 40%, the only comparable reference we have access to. In the current cycle, a second year of well-below normal enforcement would likely point to diminished regulatory zeal.